Vaibhav Global Limited

Global E-tailer of Fashion Jewellery, Apparels, Lifestyle Products and Accessories on

TV and Digital Platforms

Established in 1980, Vaibhav Global Limited (VGL) is a vertically integrated electronic retailer of fashion jewellery, home, beauty, lifestyle, and essential products, offering a deep-discount proposition to customers in the US and the UK, and with prudent plans to expand to other geographies.

Vaibhav Global Limited at a Glance

So, we can see here that the company is not only focusing on its business but also they are focused on social welfare too by their mission of delivering one million meals per day to children in need by ‘FY31’ through their one for one meal program.

VGL Corporate overview

Vertically Integrated fashion retailer on electronic retail platforms

End-to-end B2C business model

Presence on - Proprietary TV home-shopping, Proprietary e-commerce platforms, Social and third-party Marketplaces

Strong management and governance

Professional management team

Strong and Independent Board

B S R & Co. LLP - Global Auditor

Deloitte – Internal Auditor

Solid infrastructure backbone

Continued investment in building digital capabilities

Scalable model with limited capex requirement

Shop LC (US), Shop TJC (UK) and Shop LC (Germany) are brands with strong customer visibility

TV Homes accessed (FTE): ~ 110 mn

Growing online presence

Improving customer engagement metrics

Exceptional one for one social program – ‘Your Purchase Feeds

Every piece sold results in one meal for a school-going child

Provided 58 mn meals across India, US, UK and Germany

Robust customer engagement

Omni-channel B2C retail presence

Growing recognition of deep value fashion jewellery enables scaling to adjacent categories

Primary Market

The USA and UK are the primary markets. It also started in Germany now as they have promised.

Being a vertically integrated electronic fashion retailer, VGL has a retail presence in two of the largest consumer markets (US and UK) and strong sourcing network in over 30 countries. During FY21, the Company continued on its growth path, even amidst the challenging environment.

VGL’s 4R strategy

Reach, Registrations, Retention, and Repeat purchases – the 4R strategy is deeply embedded in the VGL operating model.

Performance comparison FY 21 with respect to FY20

If we compare the performance of FY 21 with respect to FY20, we have noted the following important points from the annual report of FY21.

Lets see

New customer registrations count to 3.4 lacs on a trailing twelve-month basis compared to 1.78 lacs in prior year. The total number of unique customers we catered during the year increased to 5.01 lacs from 3.62 lacs in the previous year.

During FY21, we were able to retain 51.5% of prior year customers compared to 50% the year before.

VGL sold an average of 27 pieces per customer compared to 30 pieces per customer the prior year. It needs more work to encourage customers for repeat purchase.

During FY21, VGL generated a net profit of ₹272 crores, a growth of 43% over FY20.

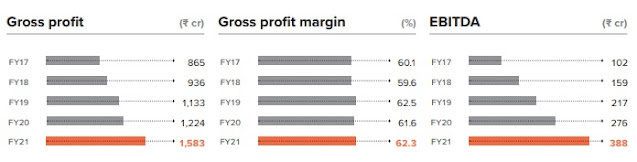

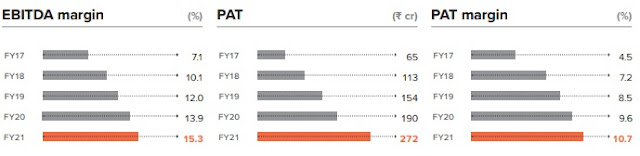

VGL distributed quarterly dividends for our shareholders.

VGL delivered a 5-year retail revenue CAGR of 16.9%, EBITDA registered a 5-year CAGR of 38.9%, and margins grew by 820 bps from 7.1% in FY17 to 15.3% in FY21.

VGL profits grew at a 5-year CAGR of 46.7% on the back of strong revenue growth and a margin-accretive business. They operate a capex-light business and enjoy significant operating leverage, providing consistency in margins.

Walk the talk

VGL has mentioned in their Annual Report that In FY22, our focus will be to operationalize our newly set up German business, in addition to strengthening our market share in existing markets. Our German business will launch in Q2 FY22 with a capex of ~US$2 million.

Lets wait to see the Q3 FY22 to secure the information about the revenue of VGL by Germany location. They are saying that German business is operational and expanding. Let's wait to see the performance of German business in Q3FY22.

Low debt paired with operating leverage allowed VGL to attain a very strong position in FY21

Lets see one by one as mentioned below

- Return on net worth of 32% in FY21 as opposed to 26% in FY20

- Return on capital employed has grown to 61% in FY21 from 46% in FY20

- EBITDA margins improved 140 basis points from 13.9% in FY20 to 15.3% in FY21

- Retail revenue has grown to ₹2,515 crores, expanding by 31.1% in FY21

The non-jewellery segment comprising fashion accessories, lifestyle products, beauty products, essential products, and apparel has grown to constitute 31% of our total retail revenues in FY21, with overall gross margins remaining within our target range of ~60%.

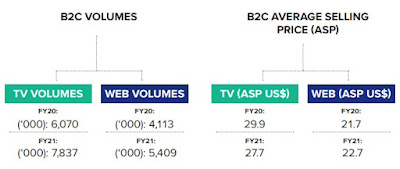

We have strategically reduced our B2B business to focus on the high margins B2C business. It now constitutes ~1% of total revenues. They mention that B2C business gives them high margins and hence it is a very positive point that VGL is focusing over B2C i.e. cash and carry business model. This business model will avoid the issue of stucking funds in trade receivable.

Television and website have shown significant growth in both the retail geographies of US and UK, adding to the company’s revenue. Our TV revenue rose by 24.9% Y-O-Y. Meanwhile, web-based revenue has grown at an exponential pace at 43.6% Y-O-Y.

US Markets

The United States is our largest market, delivering the highest revenue share. US contribution to consolidated B2C revenue is 69%.

UK Markets

UK contribution to consolidated B2C revenue is 31%.

Germany Market

Having grown rapidly in the US and UK, we see an opportunity to expand our footprint into Germany as well. A strong business model, a robust balance sheet, experienced management, and a clear vision put us in a good place to explore high ROI opportunities. Therefore, VGL is deploying capital and talent in Germany to offer our deep value proposition products to the audience there.

Germany market that offers robust growth opportunities, with the e-commerce market growing by 14.6% during 2020 to €83.3 billion. We have already registered a Company in Germany, Shop LC Gmbh, with the intent to launch omni-channel retail operations in FY22.

The German market offers vast opportunities not only in television, but also in e-commerce.

Manufacturing unit

China and India are two countries. Fully-integrated IGBC certified building at SEZ, Jaipur. Diamond jewellery manufacturing and sourcing unit in Mumbai.

Industry Overview

The year 2020 was an extraordinary one for the e-commerce retail industry, with the COVID-19 pandemic accelerating the shift of retail consumption from brick and mortar to online channels. Worldwide, retail e-commerce sales registered a sharp spike of 27.6% to US$4.28 trillion during the year. Overall, retail websites are believed to have generated almost 22 billion visits in June 2020, up from 16.07 billion visits globally in January 2020.

E-commerce Retail

Teleshopping

The global teleshopping market is anticipated to witness sustained traction over the coming years and is estimated to reach US$48,550 million by the end of 2026 owing to increasing use of mobile wallets, attractive product demonstrations, and promotion on different social media platforms.

Connected TV (CTV) and Over-the-top (OTT)

Data is expected to play a major role in extending reach and monitoring performance of ads in the CTV and OTT spaces. New partnerships and new entrants are going to keep these platforms abuzz with activity. In 2020, the total US OTT/ CTV ad spend added up to approximately US$8 billion.

This is estimated to reach US$11.36 billion in 2021. OTT/CTV ad spend is expected to double and reach $18.29 billion by 2024, with 50% of spend being cornered by YouTube, Hulu, and Roku collectively.

Social Commerce

Social commerce or marketing through social networking websites is gaining increasing popularity, especially due to the convenience factor, increased penetration of smartphones and popularity of social media. The global social commerce market size is expected to grow at a 6-year CAGR of 29.4% to US$1,948.5 billion by 2026. Easy customer reach, sharing of product posts, use of data analytics for targeted ad spends are the major growth drivers.

Business Overview

Vaibhav Global Limited is an established player in the global retail space with a strong presence in the US and the UK markets along with an extensive supply chain spread over 30 countries.

VGL is a vertically integrated fashion retailer, with multi-channel presence across well-integrated platforms, comprising proprietary TV home-shopping channels, e-commerce websites, mobile apps, smart TV, OTT platforms, social media platforms and third-party marketplaces.

Fashion jewellery contributes nearly 69% to our retail revenue, while a mix of different lifestyle products including home, beauty, fashion and accessories, and lifestyle products make up the rest.

We also have a B2B presence, which contributes to a small part of our overall revenues (~1% of revenue from operations in FY21). However, our B2B operations gives us the opportunity to study market trends, while facilitating liquidation of inventories. Our business focus continues to be on the B2C segment.

Our extensive sourcing network and backward integration capabilities allow us to offer low Average Selling Prices (ASPs) to customers and maintain high gross margins.

While we manufacture our own fashion jewellery (we have begun manufacturing textiles as well), non-jewellery products are sourced from third parties. This allows us to be scalable and flexible, provide customers with a diversified portfolio, and maintain a capital-light model.

With our growing omni-channel B2C retail presence, deeper customer engagement, and low ASPs, we are gaining greater recognition as a deep value fashion retailer in both our markets.

Our Budget Pay service, launched in FY16, allows us to offer products on EMI to customers, making purchases easier and convenient. Budget Pay sales constituted 36% of retail sales in FY21. We also have an easy return policy and a community forum in place that drives deeper customer engagement.

Our 4R (Reach, Registrations, Retention and Repeat Purchase) strategy defines our operating model and provides the business an objective assessment framework apart from helping in customer retention and engagement.

5 lacs plus Unique customers in FY21 – 38% higher than FY20

Our retail operations witnessed substantial growth in revenues during FY21, which were up by 22.2% in the US and 31.6% in the UK (in local currency), as against the corresponding sales figures for FY20.

Expansion

Germany

Set up Shop LC GmbH to expand business in Germany. This business will involve electronic retail of merchandise through proprietary television and e-commerce websites, social and marketplace platforms. Prior to setting up the Company, we had a presence in the German market on Amazon’s platform with the brand name of ‘D’Joy’.

Canada

We expanded in the Canadian market by placing products under Shop LC, on Amazon, eBay, and Walmart, Canada.

Japan

We expanded in Japan by placing products under Shop LC, on Amazon, Rakuten and BASE

UK

We launched TJC Plus (membership programme) in the UK to enhance our customer loyalty. We also launched an exclusive Live TV channel in the UK – TJC Beauty – during the year for greater visibility of our offerings.

Financial Performance for FY21

Total Revenue

We witnessed strong revenue growth during FY21. Both our retail geographies supported robust B2C sales. Revenue from operations grew by 27.9% to `2,540 crores in FY21, as compared to `1,986.4 crores in FY20. Our US operations contributed 69.1% of the total retail revenue, while those in the UK contributed the remaining 30.9%.

If we see the performance of VGL from FY17 to FY21, there is consistent growth in both major market i.e. US and UK. This shows that how VGL is maintaining a consistent growth in its revenue year on year.

EBITDA

EBITDA grew by 40.4% to `387.9 crores in FY21, as compared to `276.2 crores in FY20. Subsequently, EBITDA margins grew to 15.3% as compared to 13.9% in FY20. We have been able to maintain a steady margin growth on account of an agile business model that has given us significant operating leverage.

Profit After Tax (PAT)

PAT stood at `271.8 crores for FY21, recording a growth of 43% over FY20. PAT margins improved by 110 basis points y-o-y to 10.7%. A low debt structure passed through our operating leverage to the bottom-line.

Operating Cash Flows and Free Cash Flows

A capex-light business model, coupled with strong financial performance, resulted in improved operating cash flow of `324 crores and free cash flow of `268 crores for the period under review.

SWOT Analysis

Strengths

Omni-channel presence in the US and UK retail markets, providing an integrated and immersive shopping experience across multiple platforms such as TV, web, and marketplaces, both social and digital

Robust supply chain management

Business model capable of scaling across geographies

Professionally managed and guided by experienced leadership

Higher engagement levels with customers through deep discounts, quality products, excellent customer serv

Weaknesses

Multi-country business operations, leading to exposure to foreign exchange risks and instability in raw material prices

Opportunities

Growing customer preference for e-retail due to disruptions caused by the pandemic Convenience gaining more ground, with greater acceptance of retail players with omni-channel presence

Increased scalability in adjacent categories including home, beauty and textiles

Greater collaboration among suppliers, retailers, customers and digital ecosystem players

Business-friendly government policies enabling growth of manufacturing and exports sector Emphasis on developing highly-engaging storytelling programmes

Threats

Supply chain disruption due to uncertainties associated with the pandemic

Volatile socio-economic conditions

Larger competitors developing advanced logistics capabilities

Cybersecurity threats increasing at a rapid pace

Credit Rating

During the year FY21, the Company’s credit rating for long-term bank facilities was reaffirmed as CARE A- (A minus) with Outlook – Positive (revised from Stable), which denotes adequate degree of safety regarding timely servicing of financial obligations.

The short-term bank facilities, for forward contract were assigned as CARE A2+ (A Two Plus) and, for bank guarantees were reaffirmed as CARE A2+ (A Two Plus), which denotes strong degree of safety regarding timely servicing of financial obligations.

No comments:

Post a Comment